In the dynamic realm of financial markets, traders are constantly seeking innovative tools and strategies to gain an edge and maximize profits. One such innovation that has gained significant traction in recent years is the forex robot These automated trading systems, powered by advanced algorithms, promise to execute trades with precision and efficiency, potentially revolutionizing the way individuals engage in currency trading.

Understanding Forex Robots:

Forex robots, also known as expert advisors (EAs), are software programs designed to analyze market data, identify trading opportunities, and execute trades on behalf of users automatically. These robots operate based on pre-defined parameters and trading strategies, eliminating the need for manual intervention by traders.

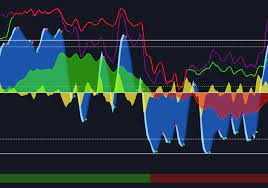

The core functionality of Forex robots revolves around technical analysis, utilizing indicators, patterns, and historical data to make trading decisions. Some robots may also incorporate elements of fundamental analysis, scanning news feeds and economic calendars to react to macroeconomic events.

Evolution of Forex Robots:

The development of Forex robots can be traced back to the advent of algorithmic trading in the late 20th century. Initially, these systems were rudimentary and lacked the sophistication of modern-day robots. However, with advancements in computing power, machine learning, and artificial intelligence, Forex robots have evolved into highly complex and adaptable entities.

Today, Forex robots come in various forms, ranging from simple scripts to advanced software platforms. Some are freely available in online marketplaces, while others are proprietary tools developed by financial institutions and professional traders.

Benefits of Forex Robots:

- Emotion-Free Trading: One of the primary advantages of Forex robots is their ability to eliminate emotions from trading decisions. Fear and greed, common pitfalls for human traders, are not a factor for automated systems, leading to more disciplined and consistent trading.

- 24/7 Trading: Unlike human traders who need rest, Forex robots can operate around the clock, taking advantage of opportunities in different time zones and markets.

- Backtesting and Optimization: Forex robots enable users to backtest their trading strategies using historical data, allowing for refinement and optimization before deploying them in live markets.

- Speed and Efficiency: Automated trading systems can execute trades within milliseconds, capitalizing on fleeting market conditions that may be missed by manual traders.

Challenges and Considerations:

While Forex robots offer compelling benefits, they are not without limitations and risks:

- Over-Optimization: There is a risk of over-optimizing trading strategies based on past data, which may not perform as well in live market conditions.

- Market Volatility: Rapid changes in market conditions or unforeseen events can challenge the adaptability of Forex robots, leading to unexpected losses.

- Dependency on Technology: Technical glitches or connectivity issues can disrupt the functioning of automated trading systems, potentially causing significant financial losses.

- Lack of Intuition: Forex robots lack the intuition and contextual understanding that human traders possess, which can be crucial in navigating uncertain or unprecedented situations.

The Future Outlook:

Despite the challenges, the adoption of Forex robots is expected to continue growing as technology continues to advance. Machine learning algorithms, natural language processing, and big data analytics are poised to enhance the capabilities of automated trading systems further.

Additionally, regulatory bodies are increasingly focusing on the oversight of algorithmic trading to ensure market integrity and investor protection. Striking a balance between innovation and regulation will be crucial in shaping the future landscape of Forex robots and algorithmic trading.

In conclusion, Forex robots represent a significant evolution in the world of currency trading, offering both opportunities and challenges for investors. While they hold the promise of efficiency and consistency, prudent risk management and a nuanced understanding of market dynamics remain essential for success. As technology continues to progress and regulatory frameworks evolve, Forex robots are likely to play an increasingly prominent role in the global financial markets.